OUR CUSTOMERS

Adhere to Know Your Customer Regulations and Local

Compliance Regulatory Reporting Requirements with Biz4x

for Professional Services

Biz4x's suite of compliance risk assessment tools are ideal for small to medium businesses that are looking for a quick, easy and cost-effective way to run background KYC checks on new customers. As part of global efforts to combat money laundering or terrorist financing, increasingly professionals like accountants, auditors, corporate secretaries and lawyers are coming under the spotlight with the implementation of new Know Your Customer laws that require them to conduct more stringent KYC checks.

-

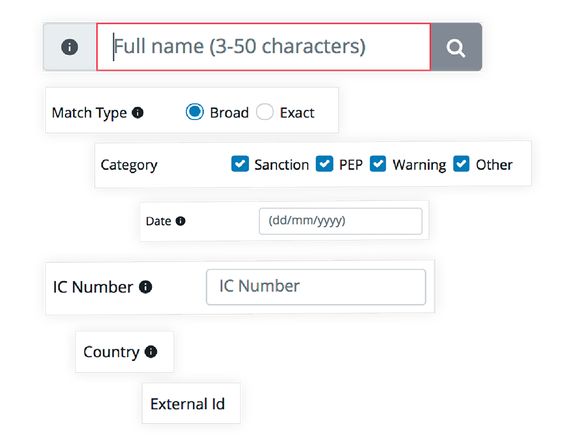

- Safeguard your business by screening customers through AML checks against a global regulatory compliance database that is updated daily with results from top global risk intelligence data providers

-

- Ensure comprehensive coverage with results from 240 territories including every category of crime, Politically Exposed Persons (PEPs), Specially Designated Nationals, Blocked Persons (SDN) and US Office of Foreign Assets Control (US OFAC) lists

-

- Easily submit KYC and AML search records dating back to a year to authorities in the event of an audit as part of regulatory risk reporting

-

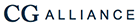

- Refine accuracy on results with filters or exact and broad search

Popular Features Among Professional Services

FEATURE #3

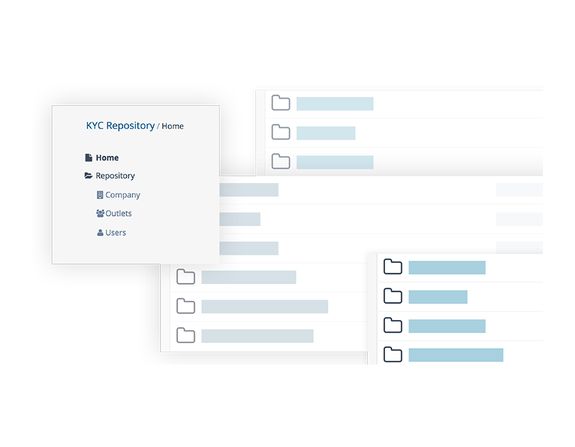

KYC Repository

Implement a risk management process with document uploads for KYC verification