Ensure Regulatory Compliance with a Risk-Based Approach to AML and CFT

Define and enforce business compliance policies through entire customer and transaction life cycles.

Features

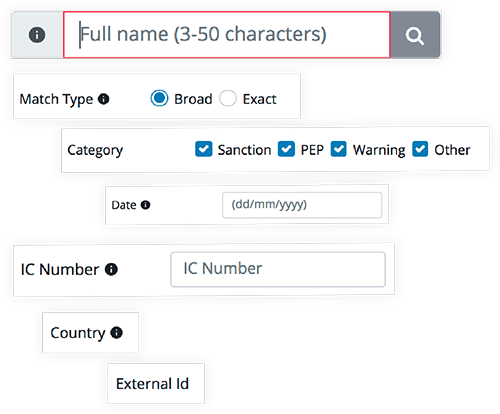

Ensure that you know your customers by accurately identifying and screening them against global sanctions, watch and PEP lists. Use secondary identifiers such as date or birth and identity numbers to reduce false positives and increase accuracy of matches.

ALSO AVAILABLE

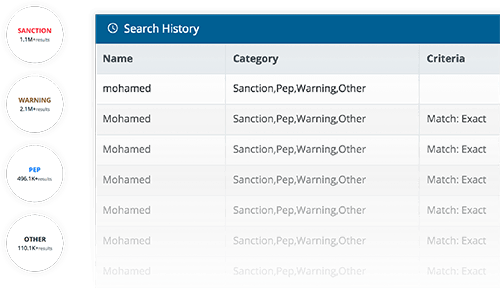

Access results from past searches across AML, CFT, PEP and sanctions lists for up to one year, so you can provide proof of AML compliance and submit multi jurisdictional regulatory reports.

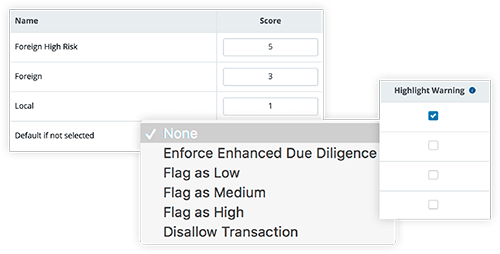

Conduct risk-based analysis through a highly customisable risk scoring system that is based on red flags for money laundering. Embed customer screening into existing onboarding workflows, and assign customers into low, medium and high risk groups for further enforcement action.

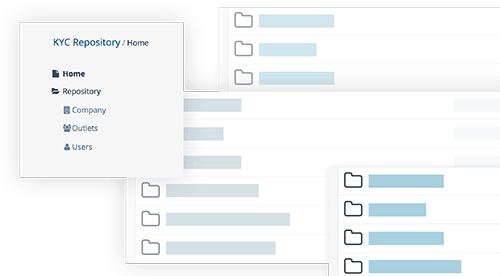

Conduct rapid customer onboarding and ongoing customer monitoring with quick and easy access to identification documents that can be uploaded to a repository and shared with business partners.

Frequently Asked Questions

Why do I need a compliance risk assessment policy for my business?

Why do I need to conduct customer due diligence?

Is Biz4x compatible with my jurisdiction?

Where does the AML compliance data for customer screening come from?

How often is the AML compliance database updated?

What results are included in the AML compliance database?

How does risk scoring in the compliance risk assessment policy work?

How can I use the KYC repository?

What new features are on the Biz4x compliance roadmap?