What Does Brexit and the Plummeting Pound Mean For Money Changers?

EU Referendum: Sterling Pound Dives as Brexit Wins

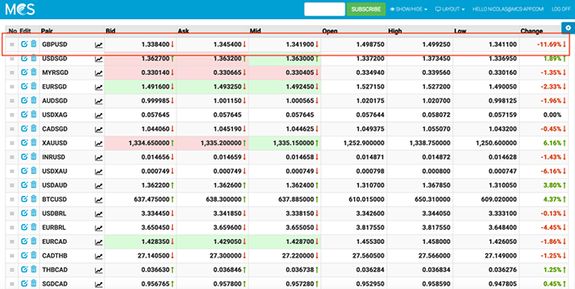

Following the results of the UK referendum, and the impending exit of UK from EU, the pound has fallen sharply. At the time of writing, the Live FX rates on our money changer software console showed that the pound had dropped by -11.69% against the USD.

The pound would later fall to $1.3305 at one stage. This is a more than 10% drop in the value of the pound which has not happened since 1985, and the biggest fall in a day that the pound has ever seen. Further market volatility is expected across Europe and the rest of the world in the coming months as more nations may opt for a referendum to decide the future of EU.

Japan has already issued a statement saying they are prepared to supply liquidity as seen in this breaking tweet from AFP news agency, and other countries may follow suit.

Already, Asia markets saw a sea of red with huge selloffs taking place.

What Does this Unprecedented Market Volatility Mean for Money Changers?

Over the last few months, economists have been talking about what a fall in the pound might mean for the average UK citizen, but how does this market volatility affect money changers across the world?

Money changers need to be careful about setting their prices, and manage their stock properly to avoid a huge loss. Ahead of the referendum, the pound had been rising in expectation that the UK would stay in the EU.

With the reality being the opposite, several money changers have stopped selling the pound in Singapore at The Arcade as of 2pm, although long queues were forming by Singaporeans hoping to get a good rate.

The Straits Times interviewed money changer Mohamad Rafeeq who said,”My cost price was S$1.97 a pound, I obviously can’t sell for anything lower than that, because I’m going to make a loss so I’d rather say I’m out of stock”.

This happened with the ringgit earlier this year as well when it fell to a record low against the Singapore Dollar. Any money changer who has stocked up on pound before the Brexit announcement may be in a fix as selling now would lead to heavy losses. In a volatile market, money changers are exposed to greater risk.

Others continued to trade at Thursday’s prices, while some of them like Mr Omar, the president of the money changers association, had earlier sold all their GBP stock as a precaution against market volatility.

Just a month ago on 26 May, the rate of Mustafa money changer was GBP 1 = SGD 2.018 / 2.041. The profit of Mustafa money changer would have been $115 on the bid-ask spread if someone had bought 5000 GBP and someone else had sold 5000 GBP to Mustafa. It will be interesting to see how money changers will respond to the market volatility in the coming week and set their buy / sell price for the GBP.