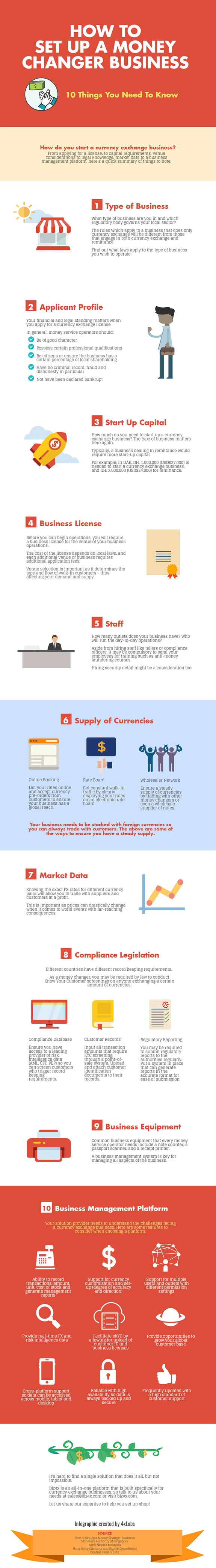

How to Set Up a Money Changer Business

Thinking about starting up a currency exchange business and uncertain about how to proceed? Not to worry, we’ve got you covered!

The key thing to note is that laws governing the set up of a currency exchange business differ from country to country and are constantly evolving due to the economic and global situation in the world today. Laws regulating money services businesses are generally concerned with two things: anti-money laundering and countering the financing of terrorism. While this article will not exhaustively go into the minute details of setting up a currency exchange business, it will outline the general considerations that one should have before starting a money changer or currency exchange business citing specific examples from a number of countries.

1. Type of Business

Who is the governing authority when it comes to the currency exchange sector in your country? In Singapore, it is the Monetary Authority of Singapore, in Malaysia it is Bank Negara Malaysia, in Hong Kong it is the Customs and Excise Department, and in UAE it is the Central Bank of the UAE. Going to the websites of these regulatory authorities will often yield detailed application forms, and legislations you should be familiar with before starting a currency exchange business.

Our white paper, The Changing Compliance Landscape for Money Changers - An Overview in 8 Jurisdictions has more info on this topic. The rules that govern your business will always depend on your type of business, for example, do you only do currency exchange, or are you involved in remittance? The types of business activities you are involved in will determine which set of rules the regulatory authority will apply to you.

1. Applicant Profile

Most regulatory bodies would mandate that the applicant is of a good financial and legal standing before granting them a license. In Singapore, you would need to be of a "good character" and 51% of equity needs to belong to Singapore citizens, among other stipulations.

In UAE, they refer to a successful applicant as being "of good conduct and behaviour" without any criminal background, and a clean financial record, with 60% shares owned by UAE nationals. In Hong Kong and Malaysia, only someone who is a "fit and proper person" will qualify.

Generally, someone who is involved in this line of business, should not have any criminal record related to dishonesty or fraud, needs to be of good financial standing, and must never have been declared bankrupt. Most, if not all countries, would have particular laws about citizenry and professional qualifications too.

Your citizenship and local ownership plays a large part here in determining whether or not your license application is successful.

3. Capital Requirement

As with all companies, to start a currency exchange business, you would require some start-up capital. In Singapore, the minimum capital requirement is S$100,000 (~USD$74,000) if you are going to be involved in remittance, while in the UAE, you would require DH. 1,000,000 (~ USD$27,000) for a currency exchange business, and DH. 2,000,000 (~ USD$54,000) if you were to engage in remittance activities. In Malaysia, start-up capital for a basic money changing and remittance businesses starts from 2,000,000 RM (~ USD$47,000), and goes up to 12,000,000 RM (~ USD$2.8 million) for wholesalers.

4. Business License

Before one can operate a currency exchange business, an application for a license, as well as a place of operations are needed. Successful application of a license depends on the ability to satisfy the above two criteria when it concerns the background of the applicant and the capital requirement as previously discussed. For Hong Kong, the validity period of a license will be 2 years, and applicants would have to pay a fee of HK$3,310 (~ USD $420) and HKD$2,220 (~ USD $280) for each additional business premise.

In Singapore, this is a new application fee of SGD$200 (~ USD $150), a first place of business for SGD$0 (~ USD$960) and an additional place of business for SGD$1,000 (~ USD$740) each. In the UAE, the period of validity for a license is 1 year, and additional places of business would require an increase in the earlier mention paid-up capital by 10%.

In Malaysia, the license would cost 500 RM, with the principal place of business being RM$500 (~ USD $120), additional branches being another RM$500, and a fee for a batch of money service business agents (max 20) that are attached to an office being RM$500. In Singapore and Malaysia, the granted license needs to be displayed prominently at the premises. For UAE, a notice advising customers of the need to obtain an official receipt, and that all rates need to be prominently displayed must be clearly exhibited.

The process of applying for a business license can be a lengthy process. Once again, the type of business, whether or not you are focused on currency exchange or remittance alone, or both, will determine what requirements need to be fulfilled in terms of security and compliance before a license is issued.

5. Staff

While you may not need a large number of staff for your currency exchange business when you first start out, you may eventually decide to hire as business grows. Such staff may include a teller to handle customer transactions and currency requests. In certain countries, it is also mandatory to appoint someone like a compliance officer.

Some countries such as the Philippines also require that you send staff working in currency exchange outlets for anti-money laundering training courses. Depending on the size of your operations and the local laws that govern your industry, you will not only need to hire, but also train staff members to take on these jobs.

6. Source of Funds

Aside from the initial start-up capital that is required, your bureau de change, money changer, currency exchange or foreign exchange houses would all need a source of foreign currency to be able to carry on with their daily operations. When it comes to the supply of foreign currencies, tourists or locals exchanging currencies with you might be a source, but this would not be a stable supply.

It is hard to predict the amount of walk-in traffic, as well as the type of currency they may want to sell for local dollars. Certainly, knowledge of the local market and state of tourism helps - perhaps seasonally you may get more tourists from a certain nationality, and thus have a greater supply of that currency. Location as well determines the types of customers (local, tourist, corporates), and supply of currency you will receive. For example in the city centre, you will see more tourists, versus the residential suburbs where currency exchange houses cater more to locals.

Booking.

One possibility to increase your supply of foreign currency might be to profile your business online through a website, or a platform that helps you to list your rates on a global directory with booking capabilities, so customers from all over the world can lock in your live rates and pre-order currency from you.

Rate Board.

To get more walk-in traffic for a steady supply of currencies, it helps to display a rate board of your Buy / Sell rates so potential customers can quickly and easily refer to the information. In some countries, it is mandatory to display this information in an obvious and clear location. Instead of entering rates into separate systems, having one platform where you can set up currencies (normal, inverse, degree of accuracy in decimal places) and choose to display them in multiple places whether online or on a rate board would not just be convenient, but effective in attracting more customers.

Wholesaler Network.

Aside from customers however, you will certainly need a more stable and steady supply of currency by trading through your money changer networks, which might be other money changers like yourself or even a wholesale supplier of notes. Consider a platform that can facilitate this process by connecting you with these partners and allowing you to do eKYC - upload and share licenses and ID documents of customers and suppliers with relative ease.

Knowing when to replenish your stock of currencies for all your different outlets is important as well. Having a point-of-sale system that is able to track all customer transactions, stock, cost and price of currencies in all your outlets in real time will allow you to keep tabs on the amount of stock of foreign currencies at all times, so you know when you are in short supply or have an excess of a certain type of currency. This would allow you to transfer currencies between outlets, or reach out to other suppliers and wholesalers before you are short of a particular currency. As such, your point-of-sale system should allow you to generate stock, transactions as well as profit and loss reports, for all or individual currency exchange outlets, whether daily or across a time period that you can define.

7. Market Data

The purpose of all businesses is to make a profit so you can make a living. Aside from having a POS system that tracks all transactions, stocks, profits and losses, you also need access to live market data to help you make the pricing decisions that can make or break your business.

FX Rates. Knowing the exact FX rates for different currency pairs will allow you to trade with suppliers and customers at a profit, especially when prices can drastically increase or fall when it comes to world events with far-reaching consequences such as Brexit, or surprise election results in different parts of the world. In the event where you do not have access to such live rates, you may find yourself trading at a loss if caught off guard. Choose a platform that can provide you with Bid, Ask, Open, High, Low prices for the currency pairs you are tracking, in multi-table format for easy comparison, which is updated in real time.

8. Compliance Legislation

As a money service business, you need to conduct Know Your Customer checks on anyone that is exchanging a large sum of currencies. Different countries have different record keeping requirements. In Singapore, it is SGD$5,000 (~ USD$3,675), in Malaysia it is MYR$3,000 (~ USD$700), in Hong Kong it is HKD$8,000 (~ USD$1,023), and in UAE it is AED$2,000 (~ USD$545). Any customers who request to exchange this amount or more would be subject to KYC background checks, and money service operators would have to obtain a copy of their identification documents. In general, a risk weighted approach is favoured by the authorities, where money changers, while subject to certain rules, also need to assess the risk of dealing with each customer accordingly. For example, a customer may be exchanging a sum of money under the record keeping trigger amount, but if that customer is repeatedly changing amounts frequently that culminate in a large sum, or for currencies that are linked to conflict zones, the money service operators might need to be more diligent about KYC screening.

Customer Records.

A point-of-sale system that allows you to create a customer record and upload soft copies of IDs would greatly facilitate record keeping especially when it concerns performing necessary KYC checks. This is especially so if they are regular customers or even corporate entities. A good platform would also allow for the grouping of customers, based on their behaviour, demographic or other similar factors. Suspicious transactions and individuals can thus be grey or black listed, so money service operators can monitor these customers more closely when they request for currency exchange services. Such a system would make it easy for you to flag any suspicious transactions for regulatory authorities, so as not to get into trouble when it comes to preventing money laundering or terrorist financing.

Compliance.

How would a money changer do their due diligence then? Simply running a Google search is hardly enough - it puts your business at great risk. Regulatory authorities sometimes recommend certain data providers for their compliance database or risk management solutions. Some of these include Thomson Reuters, Dow Jones and Lexis-Nexis. These data providers have world-leading risk intelligence databases that are updated daily with global data when it comes individuals or corporates that have been grey or black listed for anti-money laundering, terrorist financing, or placed on watch lists for being politically exposed individuals. For example, Thomson Reuters has a global database of more than 3 million results with 100,000 different sources. It includes lists from 240 countries in 60 languages from every category of crime such as Anti-Money Laundering (AML), Counter the Financing of Terrorism (CFT) and Politically Exposed Persons (PEP) lists, as well as the Specially Designated Nationals, Blocked Persons (SDN) and US Office of Foreign Assets Control (US OFAC) lists. Money changers using a solution that provides them with access to such compliance data can quickly and easily screen customers against such a compliance database, as well as print or file these results, so that they can prove they have done their due diligence in the event of an audit.

Regulatory Reporting.

Often, regulatory authorities mandate that currency exchange businesses submit reports to them in a certain format. Rather than filling out forms yourself, you might want to have a system in place that can automatically generate these country specific-reports for you. In Singapore, this would be the MA03 report and in Malaysia, it would include the MSB03 and MSB4A reports. Having such a system would make it a breeze for you to submit these reports.

Knowing when to replenish your stock of currencies for all your different outlets is important as well. Having a point-of-sale system that is able to track all customer transactions, stock, cost and price of currencies in all your outlets in real time will allow you to keep tabs on the amount of stock of foreign currencies at all times, so you know when you are in short supply or have an excess of a certain type of currency. This would allow you to transfer currencies between outlets, or reach out to other suppliers and wholesalers before you are short of a particular currency. As such, your point-of-sale system should allow you to generate stock, transactions as well as profit and loss reports, for all or individual currency exchange outlets, whether daily or across a time period that you can define.

9. Business Equipment

As a currency exchange business, you will require certain equipment for your daily operations. Common physical business equipment that every money service operator possesses include a note counter, a passport scanner, and a receipt printer. A platform that is built specifically to meet the needs of currency exchange businesses will also be a key asset in streamlining your business operations.

10. Business Management Platform

While you may be familiar with the laws governing currency exchange businesses when you first apply for a license, world events can lead to rapid changes in legislation that regulates your business. Being on top of such changes is important, hence it's crucial to ensure that your solution provider understands the challenges and changing requirements due to new laws that your business may be subjected to.

Frequency of Updates.

How often is your choice of platform updated? Two weeks, a year or never? Is it a deployed solution or a web-based solution that can be frequently upgraded? A platform that has regular product updates and new releases is critical to ensuring that your business is constantly leveraging the latest that technology has to offer. It can also mean that your solutions provider is constantly innovating and staying up-to-date with local legislation so you have a platform that is fully equipped to deal with modern day challenges.

Customer Support.

Just having a frequently updated platform might not be enough though. Being able to turn to a resource when you need to troubleshoot issues, or learn how a new feature works is essential when choosing a platform for your business. Does your solution provider offer documentation, in-person, email, chat and phone support? Are they only available during working hours or do they offer 24/7 support as well? It is useful to understand these things, and clarify the Service Level Agreement before subscribing to any platform or service.

High Availability.

In the event of a power outage, will your data be safely backed-up for restoration later? Reliability is important, and making sure you have a system that you can depend on at all times is critical. Ensure that your solutions provider whether on-premise or cloud-based, has multiple dependable data centers, with redundant power across multiple regions, so you can rest assured that your data will always be safe and secure. Aside from high availability, having a platform that encrypts your data would be ideal for the security of your business as well.

Multi-Platform Support.

How many ways can you access your data? Is it only available through log in on a desktop, or can you also access your data on the go through mobile devices like your tablet and your handphone? While it might be difficult to access the full feature set on mobile devices, having access to some of your data, so that you have a broad overview and insight to how your business is doing, even when you are traveling would be useful. Cross-platform support would thus be an ideal feature for your currency exchange platform to have.

Multi-Outlet Management.

While it might be fine when you are just starting out in your money changing business to have a platform that only supports data for a single currency exchange outlet, you may find that a problem as business continues to grow and you open up more foreign exchange houses in different locations. A myriad of factors goes into pricing decisions for different currency exchange outlets, hence you would want to keep data and pricing information about your stock of currencies, as well as expenses separate from the other business locations that you own. At the same time, you would still require a system that allows you to not just oversee business activities in one outlet, but across multiple outlets as well, by generating management reports that give you a holistic view on how all your outlets are doing.

Multi-User Support.

With multiple outlets, comes the need for multi-user support as well. How many registered users can your platform of choice support? How many users can sign in at the same time using a single log in? These and more are questions that need to be answered by your solutions provider. Different employees play different roles in your business, hence the currency exchange platform that you choose needs to support the customisation of permissions. A teller might only be able to access the transactions input dashboard, while a compliance officer might only be granted access to the risk management database and certain compliance reports. An administrator should be able to access all features as well as assign different users to different roles.

User-friendly.

Is your currency exchange platform of choice easy to use and does it have all the features you need in an accessible dashboard? Having an all-in-platform allows you manage the multiple facets of your business all through a single console, be it business management, live rates, compliance data, customer acquisition or more.

In summary, when it comes to setting up a money changer or currency exchange business, there are a number of prerequisites that need to be met before one is able to obtain a license - these criteria tend to trend along similar lines in many countries from start-up capital to an applicant's background. Aside from this however, having a successful currency exchange may also depend on one's choice of business management platform. In summary, a good platform needs to have the following features:

- - Support set-up and customisation of currencies and rates be it in different directions (normal or inverse), degree of accuracy etc.

- - Support multiple users, concurrent logins and multiple outlets, as well as track every transaction that is recorded and all activity and adjustments to stock or currency price made by these users.

- - Record separate cost/buy/sell prices, amount and unit of stock when it comes to foreign currencies for individual outlets, as well as when, why and who updated the information

- - Facilitate eKYC by recording customer name and details, allow for uploading of ID documents, that can be easily accessed and assigned to recorded transactions

- - Necessitate compliance checks every time a customer exchanges more than a required record keeping amount

- - Generate daily transaction reports showing customer and outlet details, stock and profit/loss reports for individual or all outlets

- - Provide different permission levels for different employees

- - Provide some regulatory reporting for the market you are operating in

- - Provide real-time FX rates for pricing and trading decision

- - Provide a compliance database with constantly updated data so you can screen customers against AML, CFT, PEP and other international sanctions list.

- - Provide opportunities for acquiring new customers be it posting rates online or offline, or accepting currency booking requests

It's hard to find a single solution that does it all, but not impossible. Biz4x is an all-in-one platform that is built specifically for currency exchange businesses, so talk to us about your needs and let us know how we can help you in setting up a currency exchange business. Reach out to us at sales@biz4x.com and start a free trial!