How do I set up my Risk Scoring system?

The Transaction Details and Customer Details sections on the Risk Scoring screen basically detail a list of risk factors. Policy options for Transaction Details apply to each transaction that is being recorded while policy options for Customer Details govern past cumulative transactions as well.

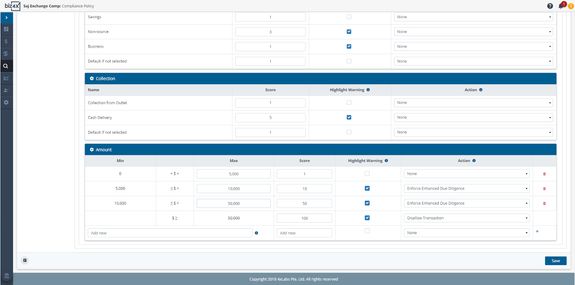

Under Transaction Details, you will find risk factors associated with each transaction such as Payment Method, Purpose of Transaction, Funds (source), Collection Method and finally, Transaction Amount.

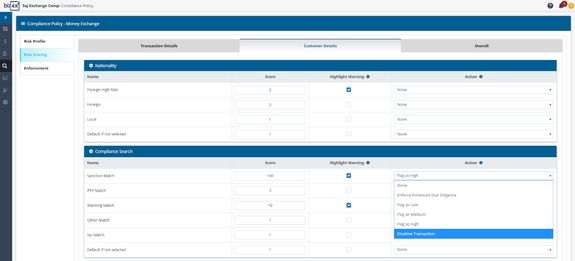

Under Customer Details, you will find risk factors associated with the customer profile and behaviour such as Nationality, Compliance Search, Transaction Volume in the last 30 days, Transaction Frequency in the last 30 days, Existing Customer and Customer Type.

Assign a score to these risk factors. Your scoring system can be based on any numerical range. Whether you choose to assign scores from 1-10 or 1-100, our system is built to cater to your choice. A higher score will mean greater risk, while a lower score is less risk.

You can request for a highlighted warning if certain risk factors are selected, by checking the Highlight Warning box beside the risk factor.

You can also select an action to take place if certain risk factors are present.

For example, you may choose to assign a higher score for certain risk factors such as a $20,000 cash transaction from someone who is not a regular customer, and is a foreigner from a high risk country like Syria. You will certainly want to assign a higher score to any sanction or warning matches, and perhaps even assign an action to disallow this transaction.

However, there are other less severe actions you can assign, such as Flag as High or Enforce Due Diligence (mandate the additional security screening options you selected under Risk Profile earlier), if you would rather avoid banning a transaction outright.

Under Transaction Details, you will see a section on Amount. If you would like to trigger enhanced due diligence for amounts above $5,000, select the Enforce Enhanced Due Diligence action for any amount above $5,000. This will mandate the actions that you had specified for Enhanced Due Diligence under Risk Profile.

In the example below, no action is taken for any amounts between $0-5,000, but the action Enhanced Due Diligence is selected and set for any amount equal to or above $5,000. To prevent any transaction above $50,000 from taking place, the Disallow Transaction option should be selected.

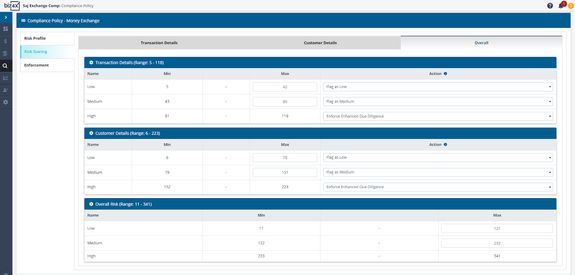

Under the Overall screen, you will see how the system has automatically created a scoring system for risk classification, based on the scores you have entered for each risk factor. The max score is a total of all the scores entered for risk factors under Transaction Details and Customer Details. The weightage of each risk factor will depend on the scores - a higher score means higher risk, which translates to a higher weightage of that risk factor.

You can adjust the scoring system for the low, medium and high risk classification, or assign certain actions to occur for each risk category. High risk transactions can be disallowed so that tellers cannot save such transactions that are flagged by the system as high risk. When adjusting scores for low, medium and high risk categories, do refer to the range of scores beside the headers: Transaction Details, Customer Details and Overall. You can adjust the max scores of each category, but only if it falls within the stipulated number range. If you want to adjust the max score, you will need to adjust the individual scores for risk factors in Transaction Details and Customer Details.